Finding Diversification Down the Market Capitalization Spectrum

January 19, 2024

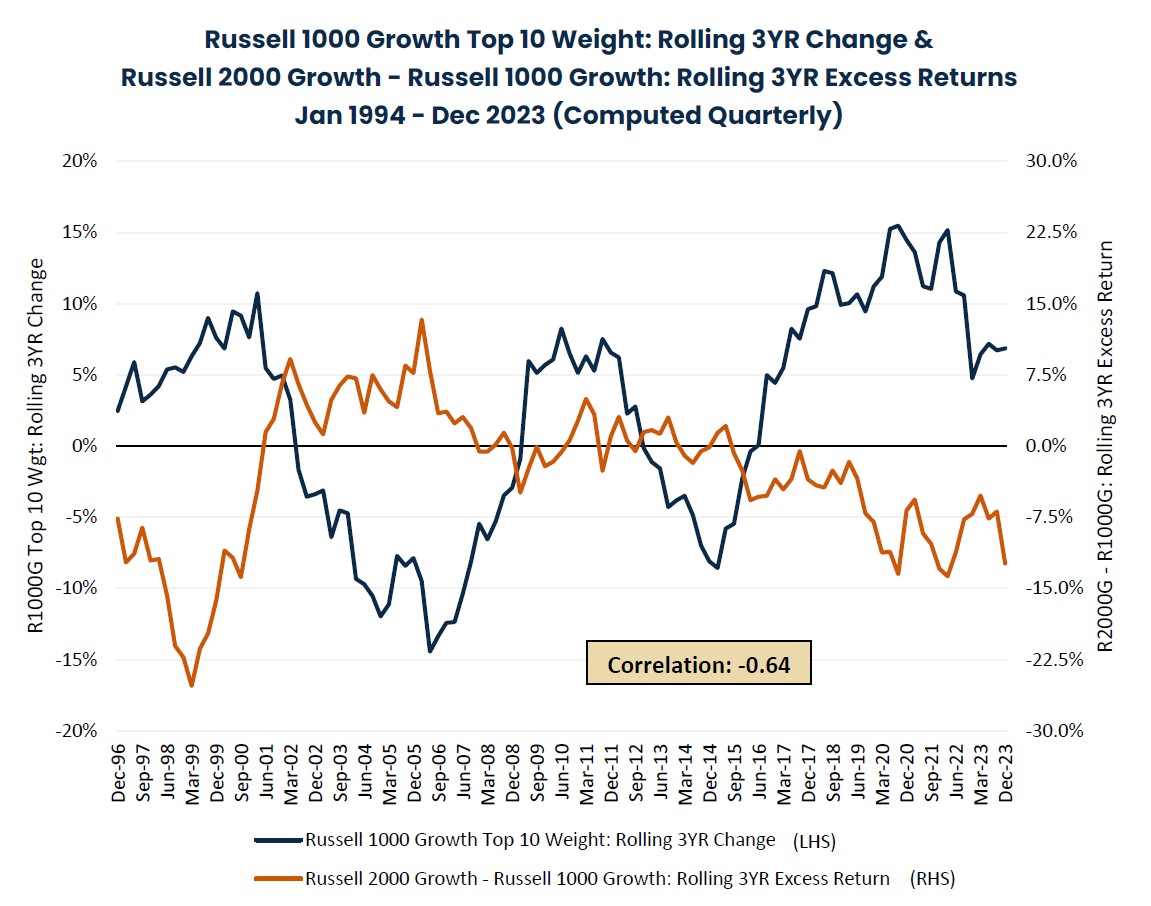

Given the recent outsized returns of a handful of mega cap growth names, many investors are considering if it is the time to seek diversification down the market capitalization spectrum for an eventual broadening out of performance returns. The chart below shows that as Russell 1000 Growth Index concentration has fallen (such as in the early 2000s), the Russell 2000 Growth Index has outperformed its large cap counterparts on a rolling 3-year basis.

Source: FactSet Research Systems and Morningstar Direct, December 2023. Performance data shown represents past performance and is no guarantee of future results. In the chart above, R1000G stands for the Russell 1000 Growth Index and R2000G stands for the Russell 2000 Growth Index.

In fact, the rolling 3-year change in the Russell 1000 Growth Index’s top ten weight has exhibited a correlation of -0.64 to the rolling 3-year excess returns of the Russell 2000 Growth Index versus the Russell 1000 Growth Index over the last 30 years. This suggests that allocating to U.S. small cap growth equities at potential peaks of large cap growth index concentration could provide potential performance benefits looking ahead.

A Potential Solution

In our view, the Harbor Small Cap Growth Fund employs a superior approach in the small cap growth asset class (as represented on the prior page by the Fund’s benchmark, the Russell 2000 Growth Index) given its seasoned investment team and disciplined growth-at-a-reasonable price (GARP) approach. The Fund’s investment team seeks to invest in only the best managed, highest quality and most optimally positioned businesses for growth with reasonable valuations. In addition, the Fund’s risk is monitored and managed throughout all steps of the investment lifecycle and from multiple perspectives. To learn more, please visit our website.

Important Information

All investments involve risk including the possible loss of principal.

There is no guarantee that the investment objective of the Fund will be achieved. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions. Stocks of small cap companies pose special risks, including possible illiquidity and greater price volatility than stocks of larger, more established companies.

Diversification does not assure a profit or protect against loss in a declining market. The views expressed herein may not be reflective of current opinions, are subject to change without prior notice, and should not be considered investment advice.

Correlation is a statistic that measures the degree to which two variables move in relation to each other.

Westfield Capital Management Company, L.P. is an independent subadvisor to the Harbor Small Cap Growth Fund.

The Russell 1000® Growth Index measures the performance of the large- cap growth segment of the US equity universe. The Russell 2000® Growth Index measures the performance of the small-cap growth segment of the US equity universe. Indices listed are unmanaged and do not reflect fees and expenses and are not available for direct investment.

3337223