IR+M: The Benefits of Specialization

October 20, 2023

Income Research + Management (IR+M), subadvisor to Harbor Core Bond and Harbor Core Plus Bond Funds, is a fixed-income specialist. The firm focuses almost exclusively on investment-grade bond sectors. Harbor has long favored asset-class specialists to subadvise our mutual funds because we think specialization brings several benefits.

First, specialization brings focus, and focus leads to deep expertise, in our view. Unlike larger firms with several different teams supporting a disparate strategy lineup, specialist investment boutiques apply a single house philosophy across its portfolios. IR+M’s philosophy is grounded on an explicit understanding of the market anomalies they intend to exploit, and the entire team is clear on their methods for doing so. Every team member is dedicated to conducting the detailed bond-by-bond research necessary to make deeply informed investment decisions, with the aim of crafting risk-aware portfolios of reasonably priced bonds from fundamentally sound issuers.

We believe that specialist firms also have an advantage when it comes to attracting and retaining investment talent. In our view, the ability to focus on a single approach attracts passionate, like-minded investors to join the firm and build a long-term career. That’s certainly been the case at IR+M, where the cohesive and experienced team boasts an average tenure of 13 years. Senior team members have navigated several credit cycles, giving them the perspective to assess bonds in a variety of market conditions. In this way, IR+M’s long tenured team has honed its expertise over time to build deep institutional knowledge, which we view as an important investment edge.

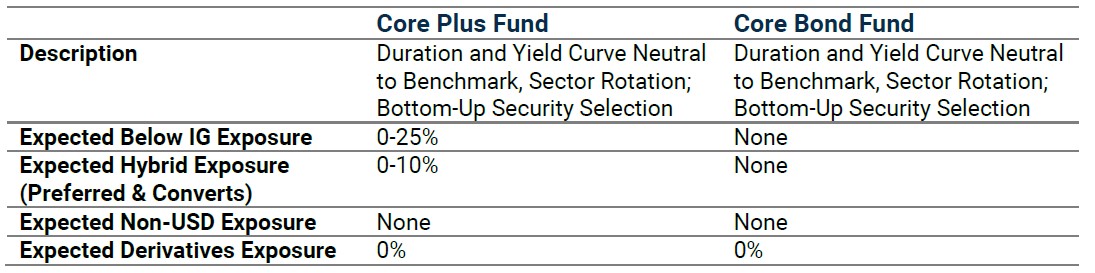

Harbor offers two ways to benefit from IR+M’s specialist advantage:

Important Information

The views expressed herein may not be reflective of current opinions, are subject to change without prior notice, and should not be considered investment advice or a recommendation to purchase or sell a particular security.

There is no guarantee that the investment objective of the Fund will be achieved. Fixed income investments are affected by interest rate changes and the creditworthiness of the issues held by the Fund. As interest rates rise, the values of fixed income securities held by the Fund are likely to decrease and reduce the value of the Fund's portfolio. There may be a greater risk that the Fund could lose money due to prepayment and extension risks because the Fund invests, at times, in mortgage-related and/or asset backed securities.

3179408